This post is brought to you by a compensated campaign in collaboration with Latina Bloggers Connect and Wells Fargo. All thoughts and opinion are my own.

Staying on top of the bills and managing credit has always been high on my list. I had to work hard for every dollar I made early on, so always knew the value behind saving and paying off debt after student loans and credit cards amassed. But money and credit management is an area most people don’t always give much thought to until an issue arises. Being proactive here and planning ahead can go a long way, especially through the holiday season when people can be most susceptible to overspending and credit fraud.

That’s why Wells Fargo understands the importance of providing financial education and has partnered with Latina Bloggers Connect to provide credit and money management tips to customers, including bilingual online tools, Spanish account statements and Spanish-speaking bankers in stores across the nation.

As part of this commitment to connect with the Hispanic community, Wells Fargo has collaborated with Telemundo for the “Conversemos de Tus Finanzas” campaign focusing on enhancing financial knowledge. The campaign will aim to help the Hispanic community be empowered to reach their financial goals with access to a number of tools such as customized content and resources around the money management and credit topics.

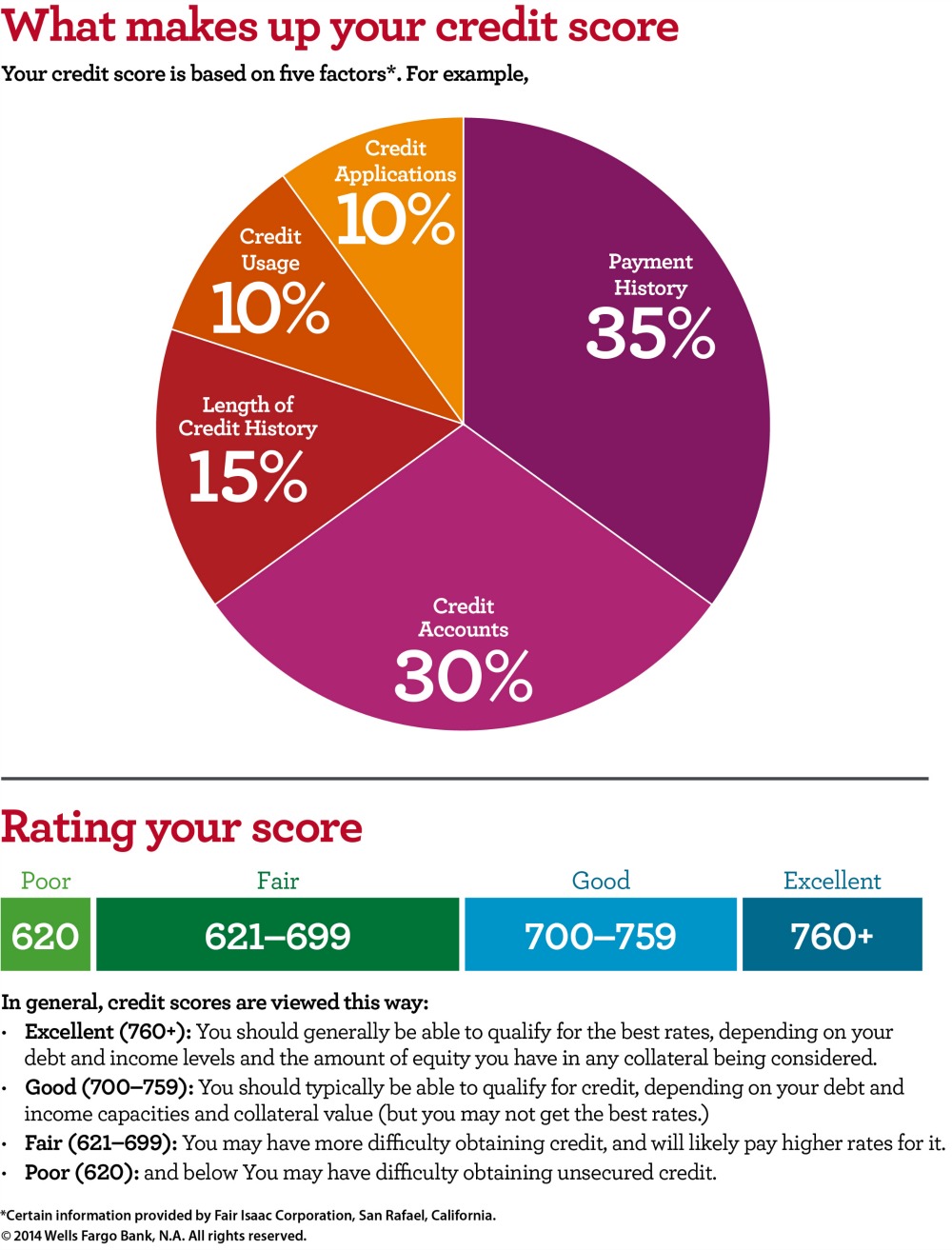

Wells Fargo has a comprehensive list of ways you can stay on top of your credit and learn to manage your money better. Below I’ve highlighted 6 of my favorite tips that will also help holiday shoppers save in the long-term and maintain a good credit score.

Wells Fargo has a comprehensive list of ways you can stay on top of your credit and learn to manage your money better. Below I’ve highlighted 6 of my favorite tips that will also help holiday shoppers save in the long-term and maintain a good credit score.

1. Prepare a budget.

This is one of the most important tips to keep in mind, because in order to spend you have to keep track of how much money you are taking in each month. You need to create a plan that clearly breaks down your total take-home pay after taxes and then allocate that money into categories like fixed, flexible and discretionary expenses. This can help you pay your bills on time (an important factor in your credit score) and see how much you actually have available afterwards to spend on gifts and leisure.

2. Learn where you can put your money.

It might be a bit confusing to hear of all the different places you can invest your money, from checking and savings to money market and retirement accounts. However, taking the time to learn about the pros and cons of each can help you make better financial decisions and find exactly what you need to reach your goals. So if it’s a big-ticket item you’re looking to purchase for your sweetheart a savings account might make more sense than a money market.

3. Track your spending.

Keeping track of how much you are spending on things like gas, food, housing, gifts etc. can help you manage your cash-flow and determine where all your money is going. Make sure you save receipts, use credit cards and take advantage of online tools to manage your spending habits better.

4. Reduce your debt.

This may seem like an obvious answer to managing your money better, but it isn’t always easy to bring down that debt. During the holiday season, stores often entice shoppers with a 10% discount when they open a store card. However, if you have several credit cards with a lot of debt, opening another account is something that can actually hurt your credit score.

5. Avoid overspending.

It can be challenging to stick to a budget during the holidays, but keeping an accurate record of your transactions and what you actually have available in your bank account can help you avoid overspending and putting yourself into unmanageble debt.

6. Keep track of your accounts.

This is such an important step in your financial management. Keep a good eye on all your accounts to prevent credit fraud and identity theft, which can severely impact your credit score. It’s a good idea to check your credit report once a year to make sure your accounts are in good standing because most of the time you won’t hear of an issue until your credit card is declined and you can’t make that special purchase.

Learn more about the many tools and bilingual resources available HERE (#WellsFargo #sponsored).

How do you keep track of spending and manage your money during the holidays?

Ana, a mom to three rambunctious little boys, has supported hundreds of thousands of women throughout their pregnancy and motherhood journey since 2012 as a blogger and maternal health advocate at MommysBundle.com.

I’d also add to look into your current interest rates. A lot of banks offer 0% balance tranfer rates for up to 15 months. Save the difference you would have been spending in interest and put that difference into a savings account.

Good point Isabel! You can really save a lot overall with low interest rates.